Basic Views

In order to fulfill our social responsibility as an enterprise and to realize the corporate philosophy of NH Foods Group (the “Group”), NH Foods Ltd. (“we”, “us”, “our” or the “Company”) has established the most optimal corporate governance system based on the Fundamental Policy on Corporate Governance.

The principles of operation of the Group are to enhance its management transparency and efficiency, to ensure timely and proper decision-making as well as appropriate business operations, to enable proactive and courageous business judgments, and to clarify its responsibility.

NH Foods Group Fundamental Policy on Corporate Governance [543KB / 38 pages]

Evaluation of effectiveness of the Board of Directors [543KB / 38 pages]

Corporate Governance Report [802KB / 45 pages]

Table for Implementation Status of the Corporate Governance Code [516KB / 19 pages]

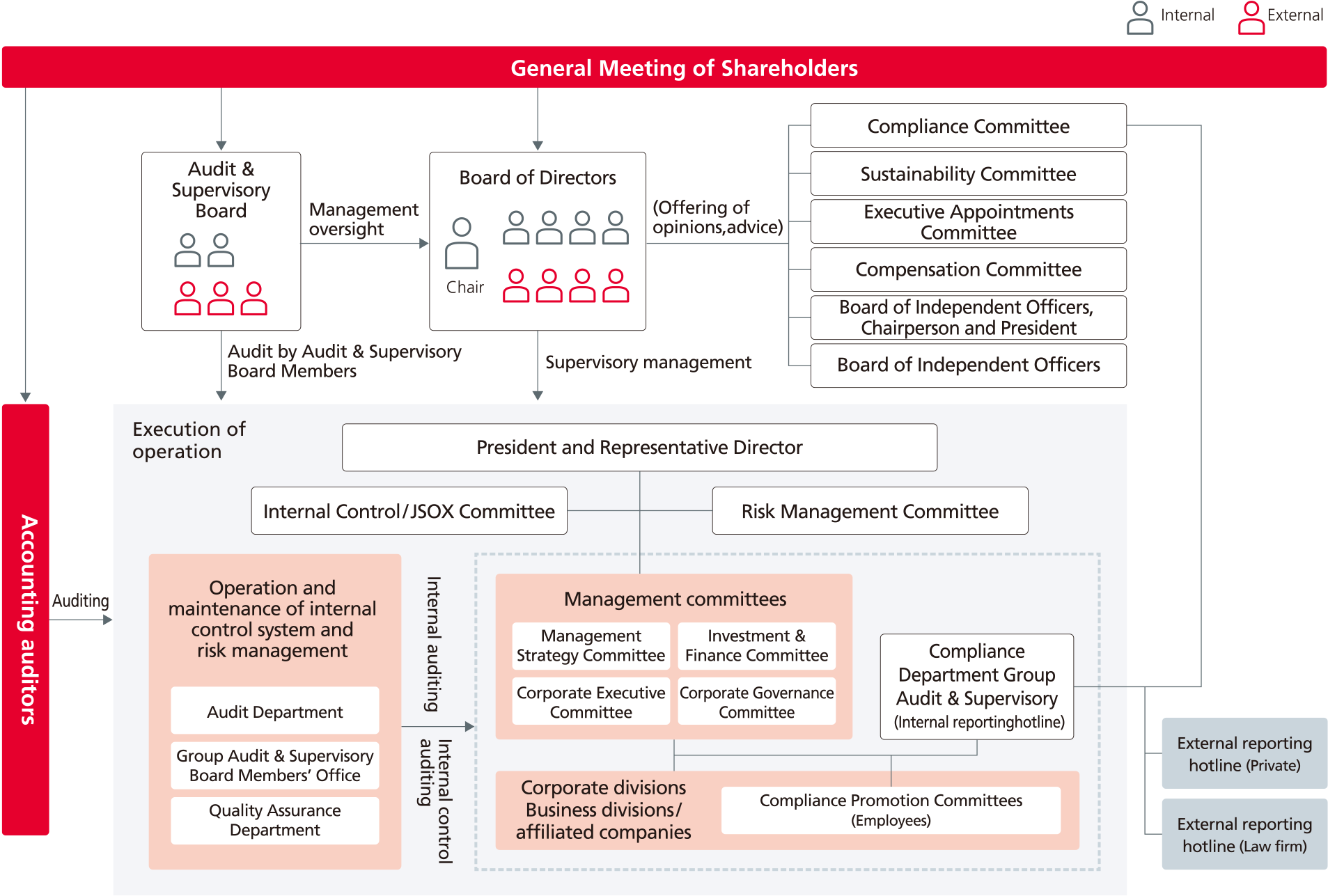

Corporate Governance System

Directors and the Board of Directors

The Company clarifies that responsibility and authority regarding the management supervisory function lies with directors and responsibility and authority regarding the business execution function lies with executive officers. We have set the number of directors to at least three but no more than 12 to ensure prompt and proper decision making and minimize the scope of liability of that body. We also appoint more than one outside director to ensure transparency. Currently, the Board comprises eight directors (six men and two women), which includes four outside directors. A director’s term is one year for the purpose of facilitating annual accountability.

The Board of Directors is held at least once a month where in the Chairperson and Director serves as the Chairperson, and makes decisions on the matters set forth in the laws, regulations, and the Articles of Incorporation, as well as other important matters.

The Board of Directors convened 18 times during the fiscal year ended March 31, 2025

Audit & Supervisory Board Members and the Audit & Supervisory Board

The Audit & Supervisory Board carries out part of the supervisory function of the Company in cooperation with the Board of Directors. As an independent body entrusted by shareholders, it audits the execution of duties by directors.

We have set the number of Audit & Supervisory Board members to at least three but no more than five to enable it to fully perform its supervisory function toward the Board of Directors. Also, in principle, over half of the members are outside Audit & Supervisory Board members. Currently, the Board comprises five members (all men), which includes three outside members.

The Audit & Supervisory Board should comprise individuals who have expertise in finance, accounting, and legal affairs, and there should be at least one member who has appropriate knowledge of finance and accounting in particular. The Audit & Supervisory Board meets at least once a month and discusses important matters concerning auditing.

The Audit & Supervisory Board convened 18 times during the fiscal year ended March 31, 2025

Optional Committees(FY2024)

To enhance the objectivity and transparency of management, the Company has established the following optional committees as advisory bodies to the Board of Directors.

| Body | No. of members (male/female) |

Chair | Objective and other details |

|---|---|---|---|

| Compliance Committee |

13 8 inside officers (8/0) 5 outside officers (3/2) |

Chairperson and Director | To ensure thorough compliance and raise society’s trust in the Group by comprehensively confirming and reviewing Groupwide compliance and making proposals to the Board of Directors and management committees |

| Sustainability Committee |

14 8 inside officers (7/1) 6 outside officers (4/2) |

Chairperson and Director | To comprehensively review the sustainability initiatives of the Group, and report and make proposals to the Board of Directors |

| Executive Appointments Committee | 5 outside officers (3/2) | Outside director | To strengthen the supervisory function of the Board of Directors by enhancing the transparency and objectivity of decisions on the selection of candidates for the positions of representative director director, and Audit & Supervisory Board member, as well as discussions regarding the dismissal and/or removal of the President and Representative Director and other management members (executive directors and executive officers) |

| Compensation Committee |

5 1 inside officer (1/0) 4 outside officers (2/2) |

Outside director | To strengthen the supervisory function of the Board of Directors by enhancing the transparency and objectivity of decisions regarding compensation for corporate officers (including executive officer) |

| Board of Independent Officers, Chairperson and President |

9 2 inside officers (2/0) 7 outside officers (5/2) |

ー | To facilitate exchanges of opinion among independent officers, Chairperson and President as a forum for making proposals regarding improvements to the Group’s corporate value and reforms to corporate culture. |

| Board of Independent Outside Officers | 7 outside officers (5/2) | Outside director | To facilitate discussions between independent directors and Audit & Supervisory Board members as a forum for exchanging information and sharing understandings from an independent and objective perspective |

| Internal Control/JSOX Committee |

19 inside officers (18/1) |

Officer appointed by the President and Representative Director | To determine internal control plans related to financial reporting, performs comprehensive evaluation of internal control evaluation results, confirms effectiveness of improvements, and makes recommendations. |

| Risk Management Committee |

12 inside officers (10/2) |

Officer appointed by the President and Representative Director | To discuss issues and measures concerning risk management (risk prevention and rapid response to business emergencies) and to report matters under consideration by the Committee and the results of discussions to the Board of Directors or at Management Strategy Committee with the aim of contributing to the management of the Group |

Reasons for Election

Outside Directors

- Yasuko Kono

- Since Ms. Yasuko Kono has rich experience and knowledge concerning consumer issues, we expect her to provide us with valuable suggestions regarding promotion and implementation of structural reform and growth strategies, and fostering of a challenging organizational culture to transform the Company under the theme of “working together to create value through protein” for the “Medium-Term Management Plan 2026.” For these reasons, we have deemed her to be the appropriate personnel to oversee the execution of business as an independent Outside Director,continues to appoint him as an Outside Director.

- Tokushi Yamasaki

- Since Mr. Tokushi Yamasaki has professional knowledge and abundant experience as a securities analyst. Therefore, we expect him to provide us with valuable suggestions regarding promotion and implementation of structural reform and growth strategies, and fostering of a challenging organizational culture to transform the Company under the theme of “working together to create value through protein” for the “Medium-Term Management Plan 2026.” For these reasons, we have deemed him to be the appropriate personnel to oversee the execution of business as an independent Outside Director, continues to appoint him as an Outside Director.

- Hiroko Miyazaki

- Since Ms. Hiroko Miyazaki has extensive experience in corporate management through serving as legal director and president and representative director at global companies. Therefore, we expect her to provide us with valuable suggestions regarding promotion and implementation of structural reform and growth strategies, and fostering of a challenging organizational culture to transform the Company under the theme of “working together to create value through protein” for the “Medium- Term Management Plan 2026.” For these reasons, we have deemed her to be the appropriate personnel to oversee the execution of business as an independent Outside Director,continues to appoint her as an Outside Director.

- Masahiko Koyama

- Since Mr. Masahiko Koyama has extensive corporate management experience, including serving as president and representative director in the hotel and leisure industry.

We expect him to provide us with valuable suggestions regarding promotion and implementation of structural reform and growth strategies, and fostering of a challenging organizational culture to transform the Company under the theme of “working together to create value through protein” for the “Medium-Term Management Plan 2026” by using his extensive experience and deep insight.

For these reasons, we have deemed him to be the appropriate personnel to oversee the execution of business as an independent Outside Director,and have appointed him as an Outside Director.

Audit & Supervisory Board Member (Outside)

- Masayuki Kitaguchi

- Mr. Masayuki Kitaguchi provides advice in a timely manner to ensure the legality and appropriateness of Group management from an objective and fair perspective based on his expert standpoint and abundant experience as an attorney-at-law and certified public accountant.

He also served as a member of the Executive Appointments Committee. - Shigeru Nishiyama

- Mr. Shigeru Nishiyama provides advice in a timely manner to ensure the legality and appropriateness of Group management from an objective and fair perspective based on his expert standpoint and abundant experience as a certified public accountant and a graduate school professor.

He also served as an observer of the Sustainability Committee. - Katsumi Nakamura

- Mr. Katsumi Nakamura provides advice in a timely manner to ensure the legality and appropriateness of Group management from an objective and fair perspective based on his professional knowledge and abundant experience as an attorney at law.

He also served as an observer of the Compliance Committee.

Evaluation of Effectiveness of the Board of Directors

The Company has conducted analysis and evaluations of the effectiveness of the Board of Directors in accordance with the NH Foods Group Fundamental Policy on Corporate Governance since FY2015 with the aim of improving the effectiveness of the Board by identifying issues concerning its structure and operation.

NH Foods Group Fundamental Policy on Corporate Governance [543KB / 38 pages]

Evaluation Process

The evaluation for fiscal 2024 was conducted using questionnaires with all directors and auditors. Also, in order to ensure that officers can be honest with their opinions and to realize objective analysis, responses are delivered directly to a third-party evaluation organization without passing through an internal secretariat.

At a meeting of the Board of Directors on April 28, 2025, there was received a report based on a report containing the objective analysis and assessment of the third-party evaluation organization. Based on this report, the Board of Directors confirmed the effectiveness of the Board of Directors and future issues.

| Response to issues identified in the previous fiscal year |

|---|

|

(1) Members and operation of the Board of Directors (2) Management strategy and business strategy (3) Corporate ethics and risk management (4) Evaluation and compensation of the members of management (5) Communication with shareholders |

Officer Compensation

Basic Policy

The officers compensation system provides compensation to individual executive directors and executive officers who have been selected from among the finest management talent and nurtured and promoted by the Company. Its purpose is to further clarify the linkage between officers, compensation and the Company’s business performance/shareholder value and to provide an incentive for enhancing corporate value over the medium-to long-term with the aim of realizing the corporate philosophy.

System development, compensation levels, system operation, etc., are to be deliberated on by the Compensation Committee, with an independent outside director acting as chairperson, and with the final decision to be made by the Board of Directors.

Regarding compensation levels for each individual officer, the reasonableness of these levels is verified every year with reference to the investigation results, etc., of third-party organizations.

Summary of Director Compensation

Compensation for directors (excluding outside directors) comprises monetary compensation (basic compensation and evaluation compensation) and performance-based stock compensation.

Basic compensation is fixed monthly compensationand is determined according to position. Evaluation compensation is a variable compensation (a fixed amount paid monthly) that fluctuates depending on annual performance (consolidated sales,consolidated business profit, ROE, ROIC) and the degree of achievement of individually set management issues.

In addition, performance-linked stock compensation, which is intended to provide incentives to increase corporate value over the medium- to long-term, provides directors (excluding outside directors) and executive officers with target values for performance indicators (consolidated Points will be awarded according to the degree of achievement for (sales, consolidated business profits, ROE), the Company's TSR evaluation (against TOPIX), position, etc., and the number will be equivalent to the number of points awarded during the term of office and at the time of retirement. This is a system in which the Company's shares are delivered to shareholders.

Performance-based stock compensation includes malus (reduction of an amount of rights granted but yet to be exercised) and clawback (return of an amount of rights that have been exercised) provisions. These provisions can be exercised in the event of one of the predetermined triggers that include certain wrongdoings, such as a serious breach of duties or material violation of the internal rules. The stock-based compensation subject to return under these provisions shall be the whole or a part of compensation for the fiscal year in which such wrongdoing takes place.

Plan for the Development of Next-Generation Executives (Selection, Training, and Transfer)

Human-Resources Characters Required for Executives

The Group is working to continuously enhance corporate value by establishing the Plan for the Development of the Next-Generation Executives and defining five “Human Resources Characteristics Required for Executives” (integrity, devotion, deliberation, endeavor, and empathy). The assessment of corporate officers involves executive officers creating a commitment sheet that incorporates these five requirements, followed by an interview with the President during which the setting and achievement of targets is confirmed. NH Foods Ltd. is also working to cultivate the next-generation of human resources who possess the five requirements by introducing programs such as a selection, training, and transfer program and an executive behavioral characteristic analysis program on a company-wide basis.

Additionally, we will expand pathways for diverse talent to become potential next-generation leaders as early as possible through “selection, education, and transfer programs” that provide employees at each level with opportunities to be selected.

Developing Next-Generation Executives

The Group implements next-generation executive planning initiatives in accordance with the process in the Guidelines for Strategic Development of Managerial Human Resources to Improve Corporate Value released by the Ministry of Economy, Trade and Industry. Our plan started in fiscal 2018 and we are currently engaged in Phase 4?“Evaluation of the results of development, and reassessment and reevaluation of related measures.” Our young executive officers participate in young managers forums with a view to cultivating next generation executive experience and creating useful contacts outside of the Group.

In order to educate newly appointed officers, we provide learning opportunities at meetings of the Board of Directors and Corporate Executive Committee (such as talks on the latest trends in corporate governance and by experienced managers). We are also introducing a voluntary program for officers run by an external educational institution so that officers can continue to improve their abilities after being appointed and can maintain and further develop the five requirements of our executives.

Additionally, we conduct 360-degree evaluations for members of Group management (at NH Foods Ltd. this includes heads of major departments and divisions or above), which incorporate feedback from superiors, peers, and people working under them. These are useful for self-development.

We are carrying out succession planning for CEO and management positions through measures such as disclosing our requirements of executives, applying various external assessment systems, and carrying out education and training. Each year we make improvements, and the details of these improvements are discussed by the Executive Nomination Committee and confirmed by the Board of Directors.

Internal Audits and Group Governance

Internal Audits and Audits by Audit & Supervisory Board Members

Internai Audits

The Audit Department (20 employees) consists of domestic business audits, overseas business audits/ERM support, and audit quality control. As for audit procedures, based on the audit plan, the Audit Department conduct audits of business processes, risk management, compliance, information security, etc. for each division of the head office and group companies from a risk-based perspective, and provide advice and recommendations for improvement. Audit results are reported in writing, but in cases of high urgency or importance, the Audit Department also provide oral reports.The Audit Department conducts audit procedures under the direct control of the President and Representative Director, and the audit results are compiled into an audit report and reported directly to both the President and Representative Director and the Board of Directors.

In order to ensure the effectiveness of internal audits, The Audit Department have established an audit quality control system, incorporated internal audit guidance and computer-aided audit techniques (CAAT), and are conducting audits based on a broader range of multifaceted data.

Auditor audit

Audit & Supervisory Board Members attend meetings of the Board of Directors, audit the proceedings, and actively express their opinions as necessary. Additionally, the Board of Corporate Auditors' audit policies, audit plans, audit results, and interim reports are reported and shared with the Board of Directors. Full-time corporate auditors take turns attending meetings of the General Managers' Meeting, Business Strategy Meeting, Executive Officers' Meeting, Governance Meeting, Investment and Loan Meeting, Risk Management Committee, Internal Control/JSOX Evaluation Committee, etc. as observers, and supervise the execution of duties by directors, etc. We are reviewing the situation and expressing our opinions as appropriate. In addition, outside corporate auditors attend meetings and participate in deliberations as members or observers of each of the aforementioned committees.

In addition, as a general rule, at least one full-time corporate auditor and one outside corporate auditor participate in hearings regarding the status of business execution, with directors hearing twice a year and executive officers and major department heads once a year. We check the status of internal control development and operation, efforts to improve the workplace environment, and the status of human resource development.

Regarding audits of domestic and overseas group companies, important bases selected based on the audit plan drawn up each year are inspected every year, and other bases are inspected every other year. We are interviewing companies about their responses to the situation, efforts to improve the workplace environment, the status and challenges of work style reform and human resource development, and requests.

The corporate auditors receive monthly reports from the internal audit department, and witness the internal audit department's audits and the accounting auditor's audits (including period-end inventory audits).In addition, the "Group Audit & Supervisory Board Member's Office", established in April 2021, will conduct audits by group company auditors who are independent from group company directors, strengthen collaboration with related departments, and improve the Group's audit function and internal control. The "Group Audit & Supervisory Board Member's Office" is working to strengthen this.

The "Group Audit & Supervisory Board Member's Office" is aim to build the organization and develop the human resources necessary to establish and realize the ideal audit system for all group companies. In collaboration with the Audit Department and Audit & Supervisory Board Members, the "Group Audit & Supervisory Board Member's Office" provided pre-assuming training for new Audit & Supervisory Board Members of Group companies and provided support for the development of new auditing tools , and worked on information sharing to improve audit quality and efficiency.

Three-way audit

The accounting auditor, internal audit department, and all of Audit & Supervisory Board Member exchange information once a month for approximately one hour each. In addition, Audit & Supervisory Board Member witness audits by the internal audit department (3 times) and audits by the accounting auditor (10 times, including year-end inventory audits). Full-time Audit & Supervisory Board Members attended 12 information exchange meetings held by The "Group Audit & Supervisory Board Member's Office" and group company full-time Audit & Supervisory Board Member in an effort to understand the situation.

Additionally, as part of the three-way audit collaboration, we held two information exchange meetings jointly held by Full-time Audit & Supervisory Board Members, accounting auditors, and internal audit department.

Main Roles and Duties of the Audit & Supervisory Board and Its Members

| Item/Audit target | Details | Full-time | Outside |

|---|---|---|---|

| Oversight and auditing of the Board of Directors | Attended Board of Directors meetings (18 times) | ○ | ○ |

| Auditing of business execution by directors | Interviewed the President and Representative Director (4 times, 2 hours each time) | ○ | ○ |

| Exchanged opinions with Outside Directors (4 times, 2 hours each time) | ○ | ○ | |

| Exchanged opinions with Chairperson and Director (4 times, 2 hours each time) | ○ | ○ | |

| Interviewed Executive Directors, Executive Officers, and general managers of major divisions, excluding the above (35 times) | ○ | ○ | |

| Important meetings other than Board of Directors meetings | Full-time Audit & Supervisory Board members attended and shared opinions at meetings | ○ | ー |

| Various Committees | Audit & Supervisory Board members attended meetings of committees and other bodies they are responsible for | ○ | ○ |

| Internal audit departments | Received audit reports (12 times) | ○ | ○ |

| Accounting and finance departments | Quarterly financial results, accounting auditor activities reports, etc. (7 times) | ○ | ○ |

| Compliance department | Report on the occurrence of consultation cases, etc.(4 times) | ○ | ○ |

| Accounting auditor | Received accounting audit plans, accounting audit reports, reviews of quarterly financial results, etc. (16 times) | ○ | ○ |

| Group companies | Interviewed representatives of Group companies and thoroughly reviewed documents based on an audit plan as an audit of the Group of companies (39 business locations) | ○ | ○ |

| Held meetings to exchange opinions with the Group Audit & Supervisory Board Members’ Office and full-time Audit & Supervisory Board members of Group companies (12 times) | ○ | △ Note |

Note: Information exchange meetings of outside auditors with the Group Auditors' Office and full-time auditors of Group companies are held on an irregular basis.

Accounting Audits

The Company has concluded an auditing contract with Deloitte Touche Tohmatsu LLC, to carry out audits in accordance with the Companies Act of Japan and the Financial Instruments and Exchange Act. In addition, the department in charge of accounting holds discussions with accounting auditors as necessary with the aim of improving the transparency and correctness of accounting procedures.

| Names of CPAs who performed audits | Name of Auditing Firm |

|---|---|

| Takashige Ikeda | Deloitte Touche Tohmatsu LLC |

| Naoki Kawai | Deloitte Touche Tohmatsu LLC |

| Yuya Minobe | Deloitte Touche Tohmatsu LLC |

Notes: Assistants who helped with accounting audits included 17 CPAs, 17 CPA-certified individuals, and 28 other individuals.

Cross-Shareholdings

In principle, the Company does not hold shares in cross-shareholdings. However, we may hold shares in cross-shareholdings in cases where it is recognized that cross-shareholding is essential to the sustainable growth of the Group or to improving corporate value, such as for reinforcing alliances in order to maintain business transactions and expand our business, and for smooth fund raising.

Once a year, we review all cross-held shares and closely examine whether factors such as the benefit of holding these shares, the risk of stock price fluctuations, and the credit risk of the issuing company are worth the capital cost, and then comprehensively determine whether holding such shares is appropriate or not.

If we determine that holding certain shares has become less necessary, we will dispose of such shares in an appropriate manner, taking into consideration matters such as stock price and market trends. There are also cases where even though the holding of certain shares has been recognized as significant, they may be disposed of based upon an agreement with the issuing company. As of the end of March 2025, the total market value of our cross-shareholdings was approximately \22.6 billion. This amounts to around 2.4% of consolidated assets, which we recognize is not a large proportion, but we will continue to review and shrink all our current investments.

Corporate Governance Report

Table for Implementation Status of the Corporate Governance Code

Table for Implementation Status of the Corporate Governance Code [516KB / 19 pages]