Overview of Shareholder Return Policies and Dividends

Shareholder Return Policies

The Company considers the return of profits to shareholders to be an important management issue. The Company’s policy regarding the determination on dividends of surplus, etc. is based on the payment of stable dividends and is positioned as part of the Company’s capital policy to achieve an optimal capital composition for the purpose of improving medium- to long-term corporate value.

Under this basic policy, for dividends of surplus, the Company targets to improve the dividend on equity ratio (DOE) to a 3% level during the period of this medium-term management plan to enhance the return of profits to shareholders on a consistent basis. At the same time, the Company will strive to raise a payout ratio of 40% or above.

In addition, to achieve an optimal capital structure, the Company considers the level of debt to equity ratio (D/E ratio) that can balance the reduction of cost of capital and the maintenance of creditworthiness required for financing. Under this policy, the Company will conduct the acquisition of own shares in a flexible manner and optimize the level of shareholders’ equity to what we deem most efficient from a cost of capital perspective, thereby enhancing our corporate value.

Shareholder Dividends

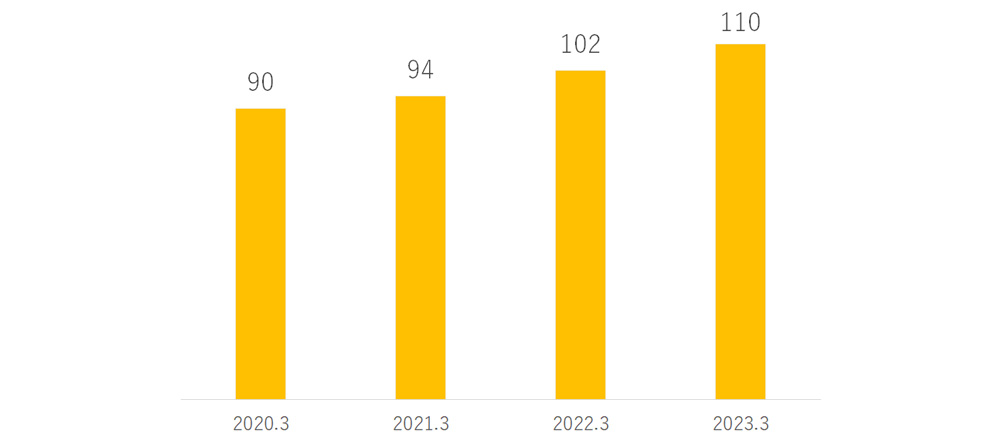

Cash dividends per share (yen)

Dividend Payment Eligibility

Shareholders of record as of March 31 are eligible for dividends. For FY2022(Period ended March, 2022), the Company paid cash dividends of ¥110 per share on June 2,2023